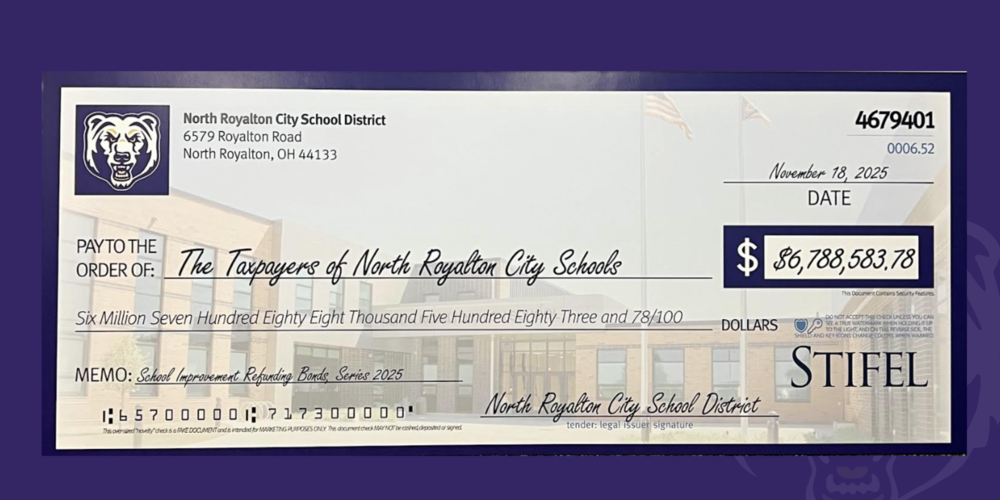

The North Royalton City School District has achieved significant long-term savings for residents and taxpayers through the sale of refunding bonds. On October 28, 2025, the district entered the municipal bond market with a $65.7 million refunding bond issuance—saving $6.79 million in future debt service payments.

This financial move refinanced the district’s Series 2017 Bonds, which were originally issued to fund major capital improvements, including construction of the new North Royalton Elementary School, renovations at North Royalton Middle School, and additions to North Royalton High School. The refunding lowers the cost of repaying those bonds, directly reducing the amount funded through the dedicated property tax levy that supports school construction debt.

The district’s leadership had been monitoring the bond market for several years in anticipation of this opportunity. When interest rates began to trend downward in September 2025—following the Federal Reserve’s rate cut of 0.25%—North Royalton City Schools moved quickly to act.

That decision paid off. During the October 28 sale, investor demand for the district’s bonds was extremely strong. Between 9:30 and 11:00 a.m., 199 separate orders totaling $383.9 million were placed—nearly six times the amount available. This high level of interest allowed the district to reduce interest rates further, adding about $450,000 in additional savings.

In total, $71.73 million of Series 2017 Bonds with an average interest rate of 4.64% were replaced with $65.7 million of new Series 2025 Bonds at a lower all-in cost of 3.97%. The refunding generated an average savings of about $310,000 per year from 2026 through 2047. The total net present value savings equate to $4.68 million, or 6.52% of the refunded bonds—more than double the industry standard benchmark of 3%.

“We have not been on the ballot for operating dollars since 2009 and continue to look for ways to stretch our budget while trying to provide savings to taxpayers,” said Superintendent Michael Laub, North Royalton City Schools. “Treasurer Biagio Sidoti is outstanding, and this is another example of his leadership in regard to our focus on fiscal responsibility. By monitoring the markets and acting strategically, the district was able to secure long-term savings for our taxpayers.”

The refunding bonds are scheduled to close on November 18, when proceeds from the new Series 2025 Bonds will be used to pay off the original 2017 issuance.

Through proactive financial management—and with the collaboration of the Board of Education and the Financial Advisory and Audit Committee—the District continues to make sound decisions that benefit both its schools and the community it serves.